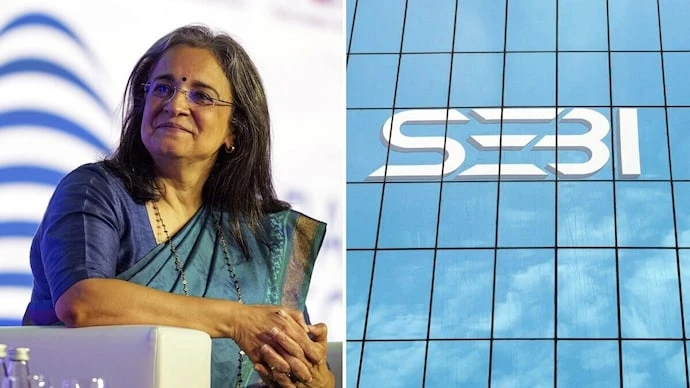

Mumbai Court Orders FIR Against Former SEBI Chief Madhabi Puri Buch in Stock Market Fraud Case

Image credits: Source Link

A special Anti-Corruption court in Mumbai has ordered the registration of an FIR against top officials of the Securities and Exchange Board of India (SEBI) including former SEBI Chairperson Madhabi Puri Buch and Bombay Stock Exchange (BSE) in a case of alleged stock market fraud and regulatory violations. The order was issued by Special Judge SE Bangar on a petition filed by Thane-based journalist Sapan Shrivastava, who alleged large-scale financial fraud and corruption in the listing of a company on the stock exchange. The complainant contended that SEBI officials failed in their statutory duty, facilitated market manipulation, and enabled corporate fraud by allowing the listing of a company that did not meet the prescribed norms.

The complaint accused SEBI officials of permitting the listing of a company that failed to meet regulatory norms, leading to market manipulation and investor losses. It also alleged collusion between SEBI and corporate entities, insider trading, and siphoning of public funds post-listing. The respondents in the complaint were former SEBI Chairperson Madhabi Puri Buch, Whole Time Members Ashwani Bhatia, Ananth Narayan G, and Kamlesh Chandra Varshney, along with BSE Chairman Pramod Agarwal and CEO Sundararaman Ramamurthy. However, in the court proceeding, none of them were represented. Additional Public Prosecutors Prabhakar Tarange and Rajlaxmi Bhandari appeared for the government of Maharashtra.

Judge Bangar, after reviewing the complaint and supporting documents, found prima facie evidence of wrongdoing and directed the Anti-Corruption Bureau (ACB), Mumbai, to register an FIR under relevant provisions of the Indian Penal Code, the Prevention of Corruption Act, and the SEBI Act. The court stated that the allegations disclose a cognizable offense, necessitating a fair and impartial probe. The judge added that there is prima facie evidence of regulatory lapses and collusion, requiring a fair and impartial probe. The inaction by law enforcement and SEBI necessitates judicial intervention. The court directed the ACB to submit a status report within 30 days, considering the gravity of allegations, applicable laws, and settled legal precedents.

The case has brought attention to the regulatory failures and corporate governance issues in the Indian stock market. The allegations against Madhabi Puri Buch and other top SEBI officials have raised questions about the integrity of the regulatory body and its ability to protect investor interests. The court's order to register an FIR against the accused officials is a significant step towards ensuring accountability and transparency in the stock market. The case is likely to have far-reaching implications for the Indian stock market and the regulatory framework that governs it.

In a related development, Tuhin Kanta Pandey has taken over as the new Chairman of SEBI, replacing Madhabi Puri Buch. Pandey has outlined the four priorities of the capital markets regulator - trust, transparency, teamwork, and technology. Restoring the credibility of SEBI and assuaging retail investors amid the current stock market mayhem, while bringing full transparency into certain high-profile investigations, are expected to be among the priorities of the new chairman. The change in leadership at SEBI is seen as an opportunity to revamp the regulatory framework and restore investor confidence in the stock market.

sebi madhabi puri buch stock fraud market mumbai court violation

Related Tags