Tariff Tensions: How Trumps Trade War Could Push Canada into Recession and Spark a Price Spike

Image credits: "Trump Tariffs to Drive Canada Into Recession, Cause Price Spike · Bloomberg" - This ominous warning from Bloomberg encapsulates the fears of economists and policymakers as the trade war between the US and Canada intensifies, with the potential to drive Canada into recession and spark a price spike, as illustrated in this image courtesy of Bloomberg.

The trade war between the US and Canada has reached a boiling point, with President Donald Trump's tariffs on Canadian energy and goods taking effect. The move has prompted Canada to retaliate with tariffs on American goods, worth an initial C$30 billion ($20.8 billion), which will expand to C$155 billion in three weeks. Economists warn that this escalation could push Canada into a recession, with the Bank of Montreal estimating a 2-4 percentage point hit to GDP growth.

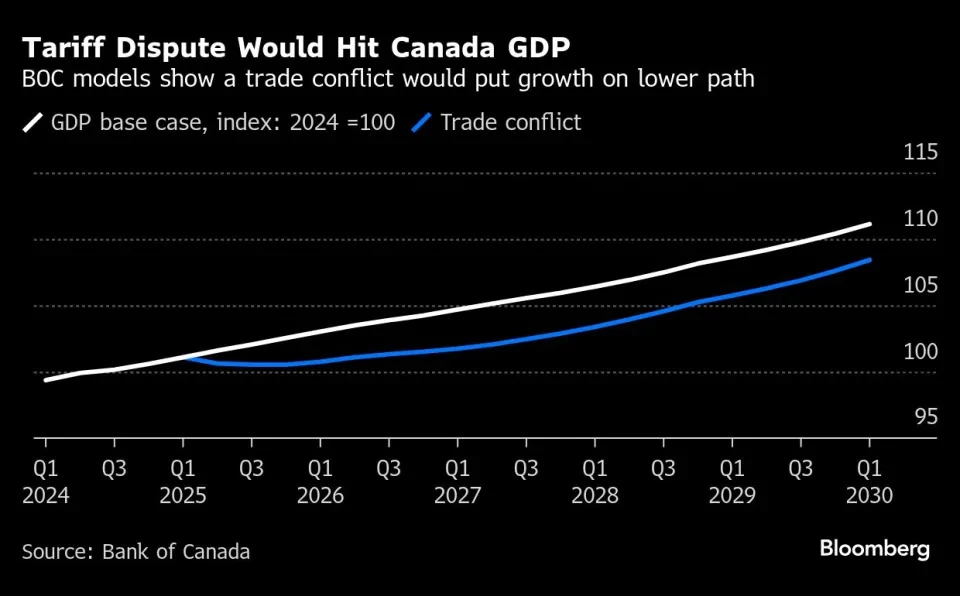

"A couple of quarterly contractions are likely for Canada, i.e., a moderate recession, before growth gradually resumes," said Sal Guatieri and Shelly Kaushik, economists at the Bank of Montreal. "Counter-tariffs and a weaker currency could see inflation spike more in Canada." This warning is echoed by Governor Tiff Macklem, who cautioned that a prolonged US-Canada tariff war would hit Canadian output by nearly 3% over two years and "wipe out growth" during that period.

The impact of the tariffs will depend on how long they remain in place, with significant uncertainty surrounding Trump's resolve. As Derek Holt, economist at Bank of Nova Scotia, noted, "Trump is a showboater and self-promoter with zero scruples, and so for all we know, he put these tariffs on just in order to be able to point to them in his speech tonight, but they may not last." This uncertainty is making it difficult for investors to predict the outcome, with traders pricing in a 95% chance that the Bank of Canada will cut its policy interest rate next week.

However, cutting interest rates may not be a straightforward solution, as it could stoke inflationary pressures. As Macklem warned, "We can't let a tariff problem become an inflation problem." The Bank of Canada is caught between stimulating growth and controlling inflation, a classic case of stagflation. With the economy already showing signs of slowing down, the tariffs could be the final straw that pushes Canada into recession.

The consequences of this trade war will be far-reaching, with Canadian consumers and businesses bearing the brunt of the impact. As Bryan Yu, chief economist at Central 1 Credit Union, noted, "Canada's retaliatory moves are economically counterproductive and limit monetary policy response, which hurts Canadian consumers, producers, and government finances." The trade war is also affecting business investment and consumer confidence, with Trump's threats alone throttling economic activity.

In conclusion, the trade war between the US and Canada has the potential to push Canada into recession and spark a price spike. With economists warning of a moderate recession and rising inflation, the Bank of Canada is faced with a difficult decision: cut interest rates to stimulate growth or risk higher prices. As the trade battle escalates, one thing is clear: the consequences will be significant, and the impact on Canadian consumers and businesses will be felt for a long time.

canada recession war trade tariff pric scenario stimulate inflation higher

Related Tags