Oil Prices Plummet: How Trade Wars and Global Energy Demand Are Redefining the Market

Image credits: None

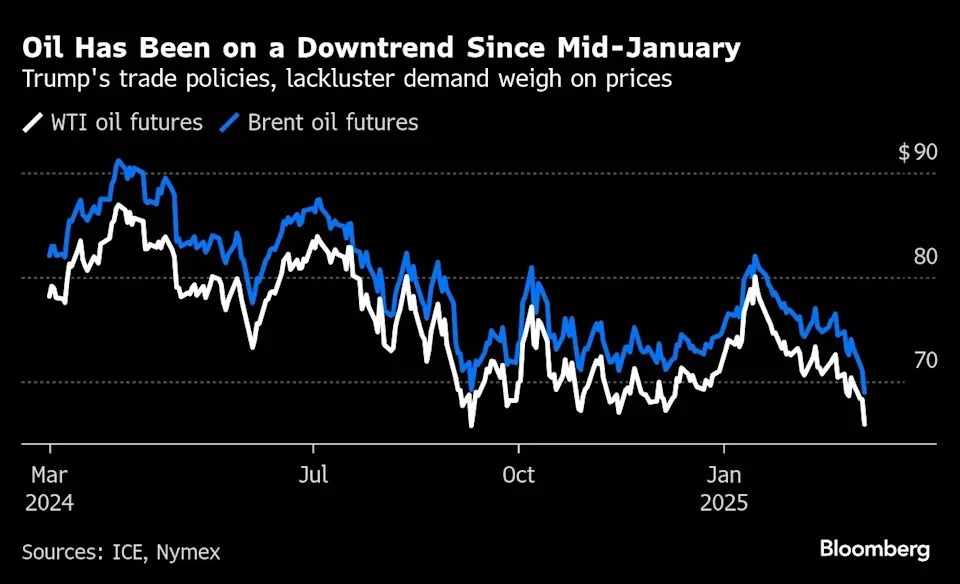

The oil market is facing a perfect storm as trade wars and increasing supply threaten to upend global energy demand. With US President Donald Trump's trade measures sparking fears of a downturn, oil prices have plummeted to their lowest level in six months. Brent crude, the global benchmark, dropped 2.4% to settle just above $69, while West Texas Intermediate fell 2.9% to settle near $66. This significant decline has left many firms revising their price forecasts lower, with some predicting that Brent crude could slide to $60 a barrel.

Understanding the Impact of Trade Wars on Oil Prices

The trade wars initiated by the Trump administration are having a profound impact on the oil market. With the US imposing tariffs on various countries, the global economy is facing a slowdown, which in turn is affecting energy demand. As Rebecca Babin, a senior energy trader at CIBC Private Wealth Group, noted, "The market is repricing the downside risk in crude, shifting from a $65 floor in WTI to closer to $60." This shift in focus from supply risks to demand concerns could signal that the market is approaching a bottom.

The Role of OPEC+ in Shaping the Oil Market

OPEC+ nations are also playing a significant role in the current oil market landscape. With a scheduled production hike on the horizon, the global supply of crude oil is expected to increase, further exacerbating the demand concerns. This has led to a surge in bearish put contracts, with oil options traders becoming increasingly pessimistic about the market. As the Energy Information Administration (EIA) data shows, crude stockpiles swelled last week, adding to expectations of a surplus.

Navigating the Uncertain Oil Market Landscape

As the oil market continues to navigate the challenges posed by trade wars and increasing supply, it's essential for investors and industry stakeholders to stay informed. With many firms revising their price forecasts lower, it's crucial to understand the factors driving the market. By keeping a close eye on global energy demand, OPEC+ production levels, and the ongoing trade wars, investors can make informed decisions and stay ahead of the curve. As the market continues to evolve, one thing is certain – the oil prices will remain volatile, and only those who stay informed will be able to capitalize on the opportunities that arise.

Related Tags