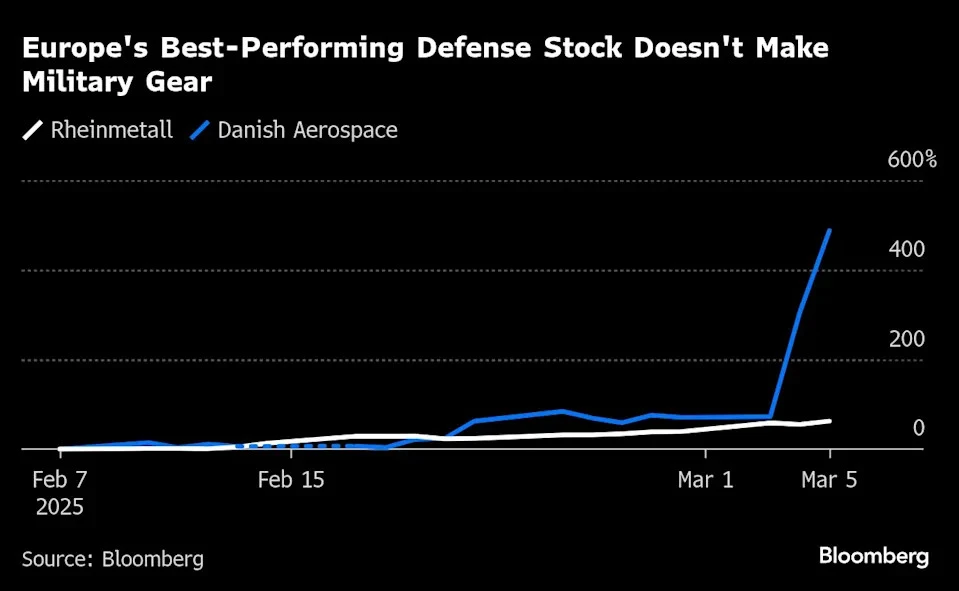

Danish Aerospace Company Soars 481% as Traders Seek Defense Winners Amid Increased Military Spending

Image credits: None

The recent surge in Danish Aerospace Company A/S's stock price has left many wondering what's behind the sudden interest in this tiny Danish company. With a 481% increase in less than a month, it's clear that traders are eager to capitalize on the growing demand for defense-related investments. But what's driving this trend, and is Danish Aerospace Company A/S really a player in the defense industry?

Understanding the Defense Investment Frenzy

The answer lies in the current geopolitical climate. As Europe takes steps to rearm in response to escalating security threats from Russia, investors are flocking to defense stocks in search of winners. This "gold rush" in the sector has created a frenzy of opportunistic investing, with traders looking for any company that remotely resembles a defense contractor. Danish Aerospace Company A/S, with its products geared towards space flight, may seem like an unlikely candidate, but its contracts and collaborations with the defense industry have caught the attention of investors.

The Rise of Defense Stocks in Europe

The surge in Danish Aerospace Company A/S's stock price is not an isolated incident. Other European defense companies, such as Germany's Rheinmetall AG, Sweden's Saab AB, and Norway's Kongsberg Gruppen ASA, have also seen significant gains in recent months. This trend is driven by the increasing demand for defense investments, as European countries look to bolster their military capabilities in response to growing security threats. With the US pulling back, Europe is taking steps to rearm, and investors are eager to capitalize on this trend.

What's Next for Danish Aerospace Company A/S?

While Danish Aerospace Company A/S's products may not be directly related to defense, its contracts and collaborations with the defense industry have sparked interest among investors. As the demand for defense investments continues to grow, it's likely that we'll see more companies like Danish Aerospace Company A/S benefiting from the trend. However, it's essential to remember that this surge in stock price is largely driven by speculation and opportunistic investing, rather than any significant changes in the company's underlying business. As such, investors should approach with caution and carefully consider the risks and potential rewards before making any investment decisions.

Related Tags