Welcome to our BMR AI CHATBOT.

A free expermental AI tool where you can interact with the webpage, ask question about the webpage and other related doubts.

In some cases reponses may take time to get. In case of error give us your report.

You responses are stored for experimental purpuses. And your personal info is not integrated with you in any way.

Note: AI can make mistakes and can give in appropiate responses. Your feedbak will help us improve.

Stay tuned for more AI products and tools

And Finally don't forget to give your feedback. click on the icon provided to give feedback.

| S.No. | Insurance Policy |

|---|---|

| 1. | LIC e-Term Insurance Plan |

| 2. | ICICI Pru iProtect Smart |

| 3. | SBI Smart Shield |

| 4. | HDFC Click 2 Protect Plus |

| 5. | Max Online Term Plan Plus |

You may find a wide variety of term insurance plans available in the market with various benefits. However, it would be good if you do not follow a one-size-fits-all approach while considering the term insurance benefits.

You should take adequate life cover based on your financial liabilities and select appropriate add-ons based on the kind of coverage you are seeking. Keep in mind that you know and understand various facets related to buying term insurance plans online or offline before you buy one. As a rule of thumb, buy a term insurance plan with a cover that is at least eight to ten times your annual income. For example, if you currently earn Rs. 5 lakh in a year, then you should select a life cover of around Rs 40 – 50 lakh or more to get the maximum benefits of a term insurance plan.

Term insurance offers more coverage for a lower premium, is easy to understand, and has significant tax advantages. However, before accounting for all these advantages, keep in mind that the primary goal of insurance is protection, not savings. Term insurance, unlike the majority of life insurance products, stays true to this goal.

Disclaimer: This blog is purely educative and is not intended to provide advice on investments/securities quoted herein or elsewhere.

Last modified on: 14/05/2024

Cryptocurrency has become a popular investment option to make money online. Cryptocurrency has be...

Gautam Adani, a top industrialist who routinely makes it to the top 2 or 3 in all India and Asia ...

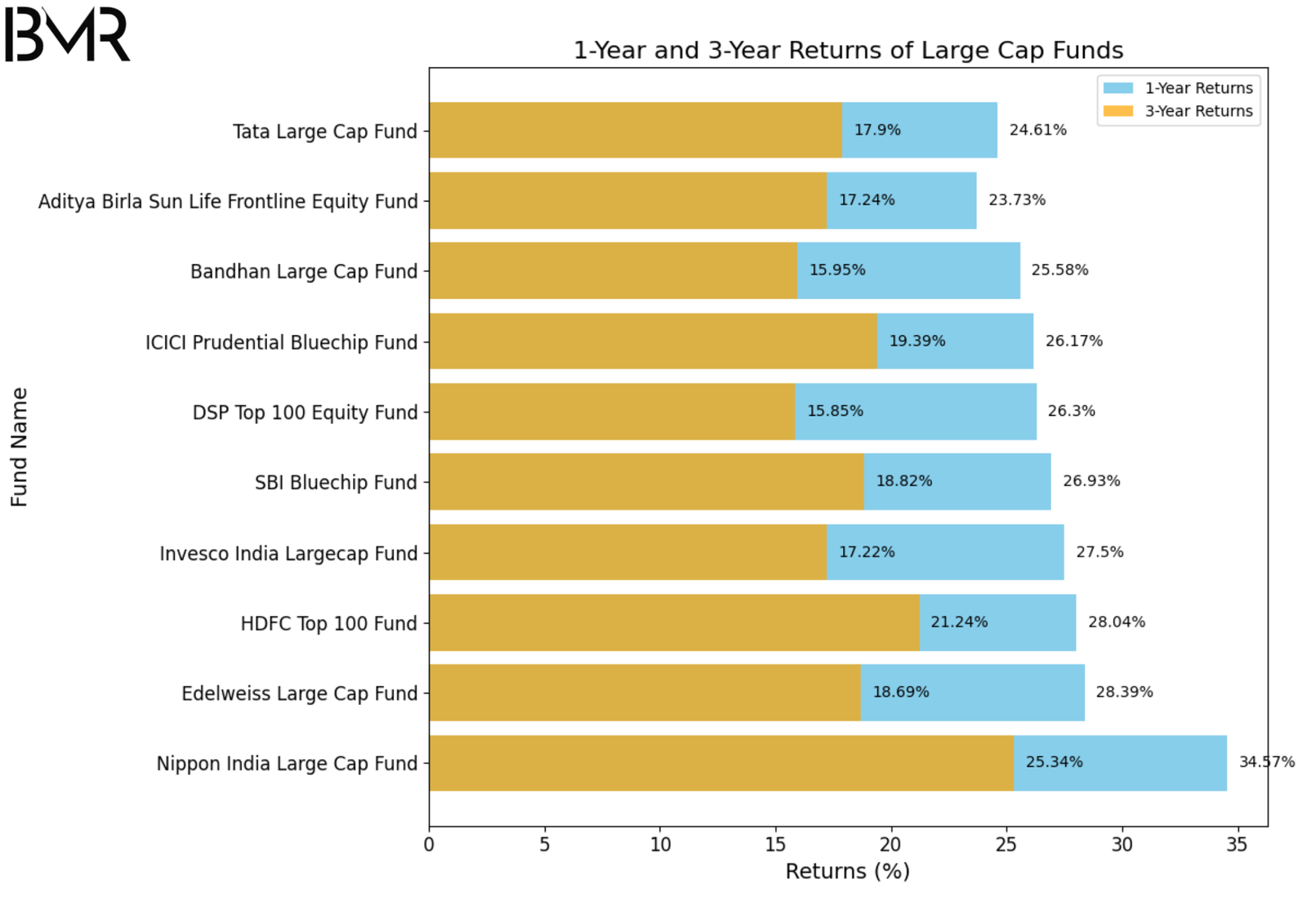

The funds listed below invest in equity & equity-related instruments of large-cap companies, ...

Term life insurance refers to coverage that provides temporary financial protection for policyhol...

You may find a wide variety of term insurance plans available in the market with various benefits...

Maturity claims and death claims are the two types of claims that you can file under a life insur...

The stars of an International team’s jersey indicate the number of world trophies they have won...

It’s the process of converting special characters and symbols into their corresponding HTML ent...

In 1900, India first participated in the Olympic Games. Indian athletes have won 38 medals till 0...

Let's create a Range Slider using HTML, CSS, and JavaScript. We use Range Slider especially ...

Let's create a calculator using HTML, CSS, and JavaScript. We use calculators for basic arit...

Starting a blog is easy. Many people earn money through blogging as a main side income stream. Yo...